Refund Reason

Refunds are an essential aspect of cross-channel payment operations. In the NGO Portal, each payment is assigned a unique reference, enabling you to track payments and refunds, and accept returns in-store, regardless of whether the product was purchased in-person or online. You have the option to refund the entire or partial value of a captured payment, which will return the previously settled funds from your customer.

Navigation

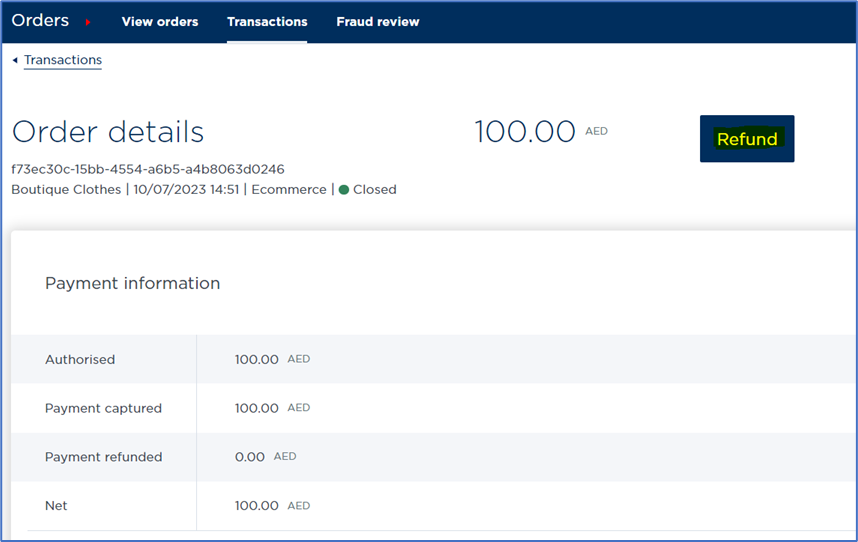

Log in to the portal and locate the order that the shopper wishes to return. Ensure that the full amount has been captured and the order status is closed. To start the refund process, click on the "Refund" button.

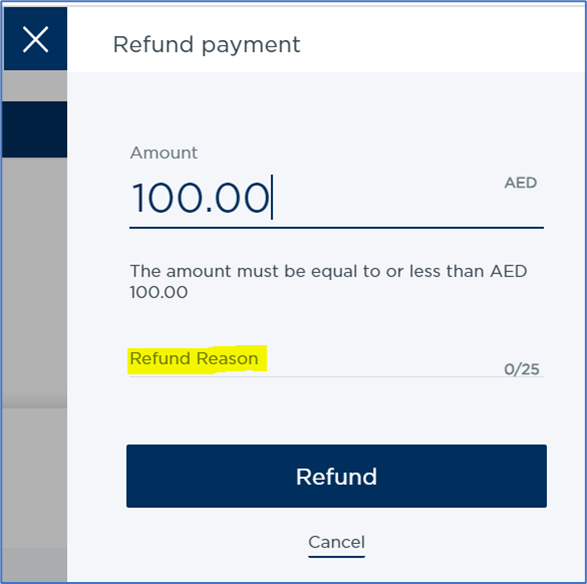

This action will take you to the Refund payment screen, where you can modify the order's cost. Before submitting the refund, enter comments in the "Refund reason" text field.

This allows you to track the reasons for refunds from shoppers as well as you can enter the place where refund is taking place and make necessary business improvements. Click the "Refund" button to confirm. The refund processing time may vary depending on the card issuer.

Full Refund:

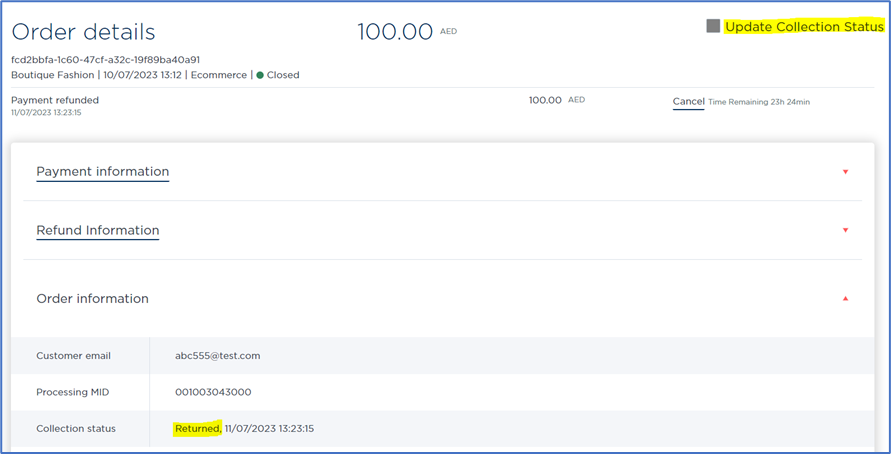

If both Refund Reason and Order Status propositions are enabled for your account, you will see an "Update collection status" checkbox on the order details page.

If you do a full refund to the shopper, the 'Update collection status' checkbox will be unchecked automatically, and the collection status in the order information section will be updated as 'Returned' (Make sure the full amount has been refunded for the order).

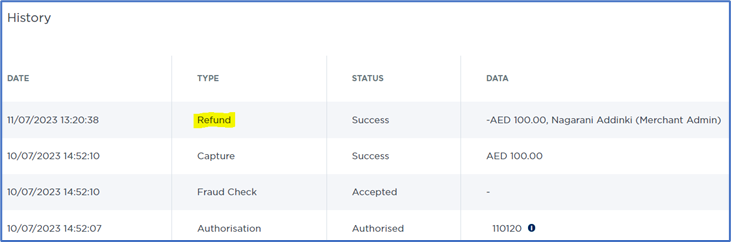

Viewing Refund History

If you would like to see a history of the refund updates, there are two ways to do this:

1. Via the Order Information screen

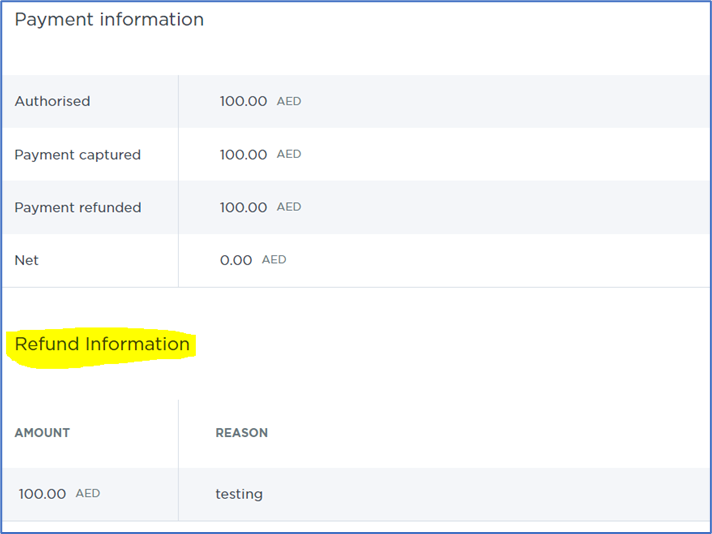

Find the required order from the Order List screen, open it, then expand the order information and refer to the “Refund information” section.

On the same page, expand the History section to view a record of each refund made for the order.

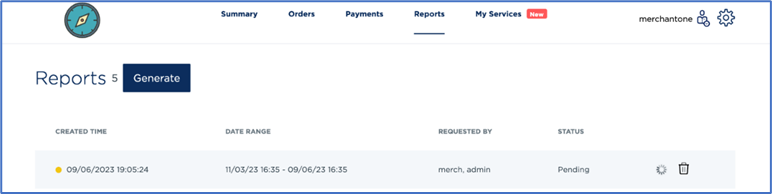

2. Via the downloadable reports

Click on "Generate" after selecting your desired filters. The report will appear in the download queue with a "Pending" status.

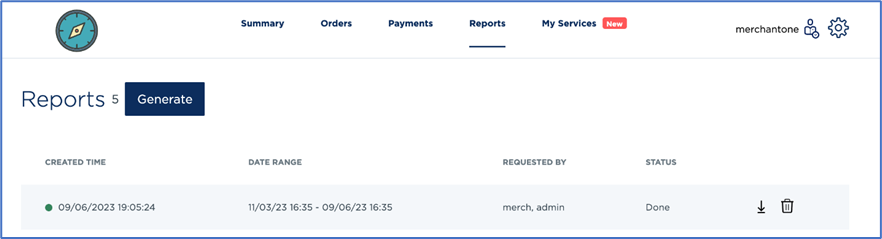

Once the report is downloaded you will receive an email notification. Return to the portal and click on the download button to access the report.

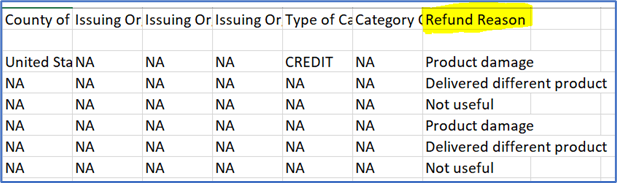

Open the downloaded Excel file to view records, including the refund reasons.

Updated 4 days ago